In today’s financial landscape, securing a loan can be a daunting task, especially when traditional lenders impose stringent criteria. However, a lesser-known yet highly effective method involves leveraging gold coins. This guide delves into the nuances of obtaining a loan on gold coins in Sydney, offering insights, tips, and everything you need to know to make informed decisions.

Understanding Loan Against Gold Coins

A loan against gold coins is a secured loan where your gold coins act as collateral. This arrangement provides lenders with security, allowing them to offer favorable terms and lower interest rates compared to unsecured loans. In Sydney, this option has gained popularity due to its accessibility and relatively straightforward process.

Benefits of Opting for a Loan on Gold Coins

- Quick Access to Funds: Unlike traditional loans that may take weeks to process, loans against gold coins often provide rapid access to funds, making them ideal for urgent financial needs.

- Lower Interest Rates: Secured loans generally come with lower interest rates, reflecting the reduced risk for lenders. This can translate into significant savings over the loan term.

- Preservation of Credit Rating: Since the loan is backed by collateral, the borrower’s credit rating may have less impact on loan approval, making it accessible to a broader range of individuals.

Steps to Secure a Loan on Gold Coins

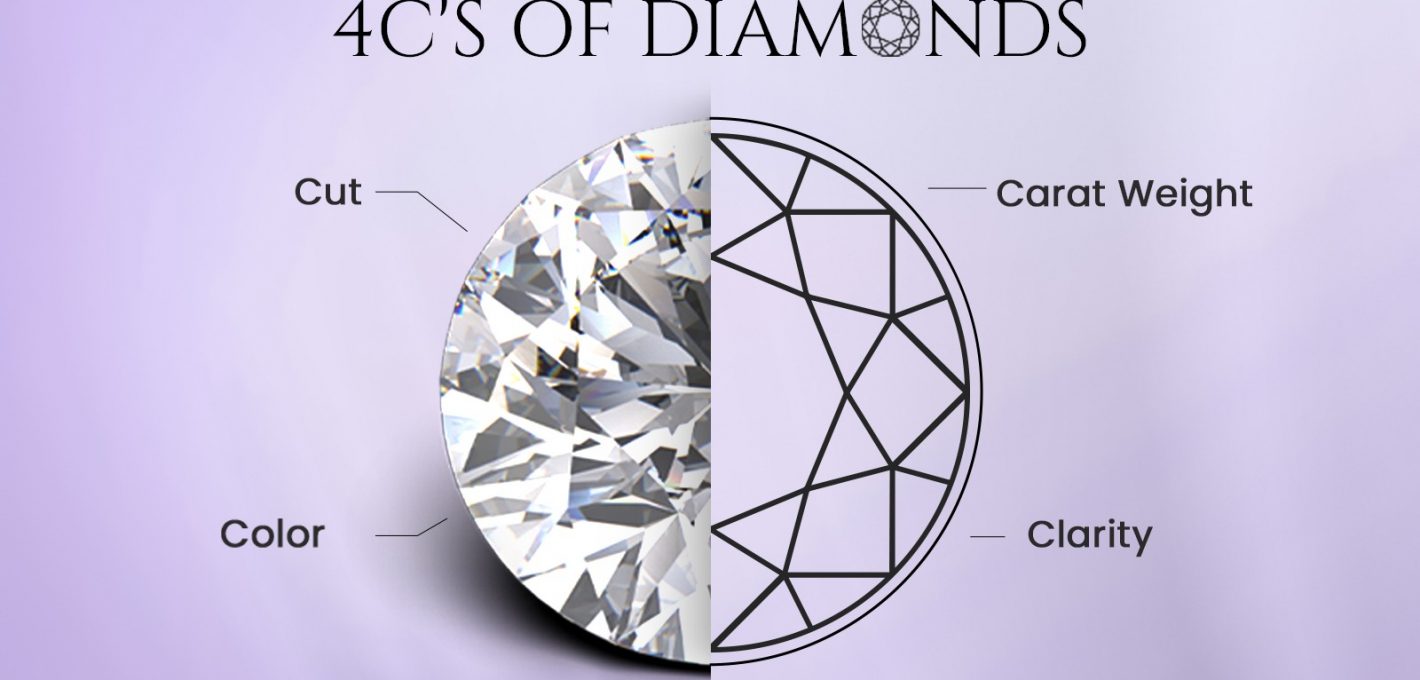

1. Evaluation of Gold Coins

Before approaching a lender, it’s crucial to have your gold coins evaluated by a reputable appraiser. The loan amount will largely depend on the purity and current market value of the coins.

2. Choosing the Right Lender

Research local financial institutions or specialized lenders in Sydney that offer loans against gold coins. Compare interest rates, repayment terms, and customer reviews to select a lender that best suits your needs.

3. Loan Application Process

Once you’ve chosen a lender, initiate the application process. Prepare necessary documents, including proof of ownership of the gold coins, identification gold buyers Melbourne, and any additional paperwork required by the lender.

4. Loan Approval and Disbursement

Upon approval, the lender will finalize the terms of the loan agreement. Funds are typically disbursed promptly, often on the same day, providing immediate financial relief.

Factors to Consider

While loans against gold coins offer many advantages, borrowers should exercise caution and consider the following:

- Risk of Default: Failure to repay the loan could result in forfeiture of the gold coins, so it’s essential to borrow responsibly and within your means.

- Market Fluctuations: Gold prices can fluctuate, affecting the value of your collateral. Stay informed about market trends to mitigate potential risks.

Conclusion

In conclusion, leveraging loan on gold coins Sydney can be a prudent financial strategy, offering quick access to funds, favorable interest rates, and flexibility in repayment. By understanding the process, evaluating risks, and choosing a reputable lender, individuals can navigate this option confidently.

+ There are no comments

Add yours